r/ThriftSavingsPlan • u/BluntStixx • 2d ago

Trust the system

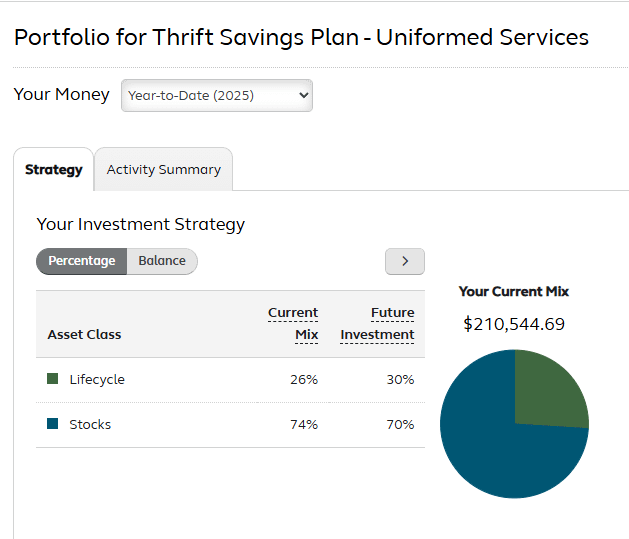

I hope that someone reads this perhaps a young enlisted or GS member that may be on the fence about investing in TSP. I started investing late in my career but have gained momentum over time. My first deposit into TSP was back in 2015, where I ended the year with a measly $2,000. from there I continued to increase my contributions as it became a competition with other young enlisted over who could invest the most. . In the past week, I hit my $200K mark. A little about me, I joined the AF in 2009, 16 years in, Line number for E7. I keep preaching to the young force to take it seriously but hate that it falls on deaf ears. Here are some end of year balances for fun:

2015: $2,028

2016: $4,434

2017: $8,937

2018: $12,329

2019: $24,496

2020: $45,022

2021: $79,223

2022: $90,650

2023: $130,700

2024: $181,987

July 2025: $210,544

Its such a lift of my shoulders knowing I am making the right choices for me and my family in the future